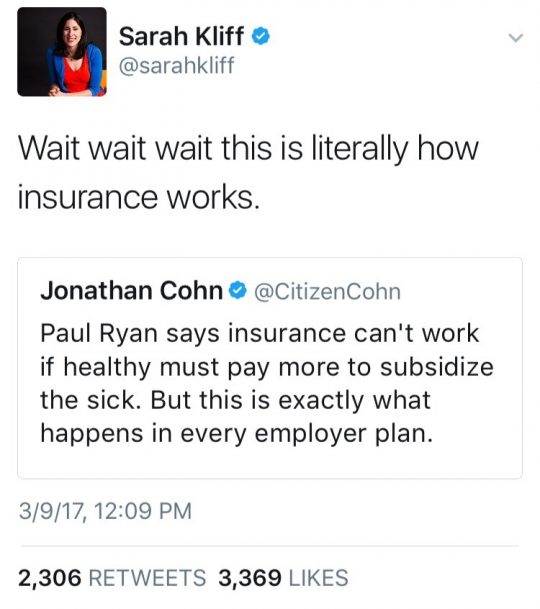

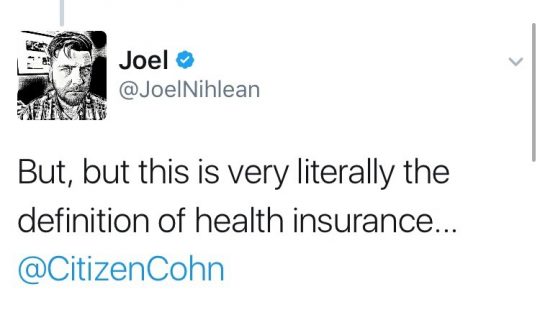

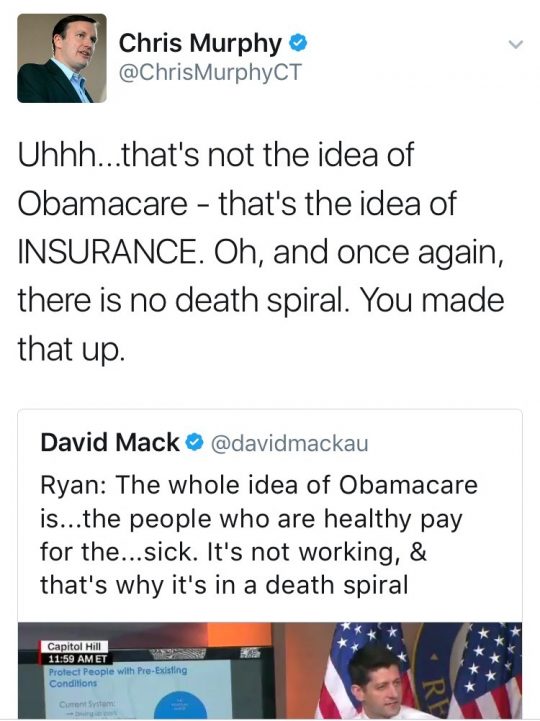

Glad Republicans took the time to understand how health insurance works before they put together a health insurance bill that will impact millions of Americans.

Oh my fucking god.

I am a licensed insurance agent, let me tell y’all something.

There is a thing in our lives called RISK, okay. Risk exists because there is a chance of loss. If you have a car, you could crash the car. You would then have to pay to fix the car, pay for your injuries, pay for someone else’s injuries, pay for THEIR car, and also pay any fines and tickets you might have incurred thanks to the crash. Plus if they sue your ass for more money, you have to pay for a lawyer. That’s the RISK of having a car. How do you get rid of this risk? You don’t have a car. Having a car is what we call ‘exposure’ – the circumstance that opens you up to the risk of a loss.

Y’all with me so far about risk and exposure?

There are four key methods of managing risk. The first is Avoid. In this instance, you can Avoid the risk by not having a car. Of course, this method isn’t perfect because other people could still hit you, a pedestrian, with their cars.

You can Retain the risk. Basically, this means you own the car and you don’t have any insurance. Shit happens, you pay for it. A digression, but some states actually have laws in place for this – if you’re rich enough to conceivably pay all your own loss bills, you can prove it by putting up a $50,000 bond with the state insurance board, and then you are formally excused from having to buy insurance.

You can Reduce the risk. Buy a very safe car, follow all traffic laws, drive very seldom. You can minimize your risk this way, but you haven’t eliminated it, so there’s still the chance of a serious loss, especially because there are other people on the roads and some of them are careless and stupid.

So here we have three methods of managing risk. One only works for the super rich. The other two are far from foolproof. So what the hell are we supposed to do, so that a car accident, which happens every day, doesn’t cause such a catastrophic financial event that we’re in debt for the rest of our lives because we missed a stop sign?

That’s why insurance exists. Insurance is a manifestation of the final and most successful method of managing risk: TRANSFER.

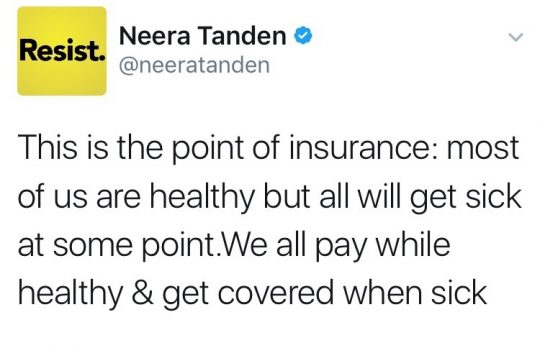

When you transfer your risk, someone else agrees to share that risk of loss with you. You both help insulate one another against loss. When large communities pool their risk, the entire community has better financial stability and better protection against catastrophic loss. Yes, it means some people may pay for a service they never use, but they are part of the community too. What helps the community helps them, whether they recognize it or not.

For instance, let’s say that it wasn’t required to buy car insurance to drive (I’m aware that in at least one state it’s not, just bear with me please, and don’t all look at New Hampshire at once, it’s rude and they might shoot you). Buying car insurance is an absolute choice. Only those who actively choose to pool their risk do so. Think about how much they would have to pay if only a few people were members of the pool. Think about the rates we’d have to charge to ensure these people were covered in the event of a catastrophic loss.

When EVERYONE pays a little, EVERYONE pays less. That’s a fundamental aspect of risk transfer.

Now we’ve been talking about auto insurance, which is my wheelhouse. But let’s talk about Health Insurance.

Every single person here has a human body. BEING ALIVE exposes us to health risks, and there is no Avoiding it. Only the truly wealthy can afford to Retain that risk but thanks to the fuckery of various incarnations of our government, many of us are FORCED to, and as a result, if we suffer a catastrophic loss, we are helpless in the face of exactly the sort of life-destroying debt and retribution that insurance exists to insulate us from! Sure we can reduce the risk in a few ways, by trying to be healthier, but many conditions are hereditary and some people just plain don’t have that fucking option – they were born broken and they’ll always be broken and they are not served in any way by others telling them “JUST DRINK MORE WATER”.

The ONLY REASONABLE METHOD of managing health risk is widespread transfer. It’s creating a massive pool into which everybody pays a little, so the money is there when someone needs a lot. And if you don’t believe me, look at the other countries that are doing this successfully and waving it in our goddamn faces because fucking Americans can’t get our act together.

Now you have read a handy primer on what the fuck insurance is, why it’s necessary, and how it works. Please spread this like wildfire, because ignorance hurts everybody, kind of like how really fucking expensive opt-in health insurance hurts everybody except people who were already rich enough not to need it.

So… put in these words… (correct me if I’m wrong- I’m kind of making a mental leap and a lot of the insurance stuff was never actually explained to me.)

Insurance already works on a socialist model of co-operative payment. You pay your share, and if you don’t use your share it goes towards a possible emergency in the future OR someone else’s emergency. Which is why it’s important to have as many people in as possible- because it (in a perfect world) would lower the cost.

Am I understanding this right? That the phrase ‘socialized healthcare’ is kind of a redundancy?

Yes, you are understanding it right. The entire concept of insurance is based on socialized transfer of risk to remove the burden from individuals so that everyone can actually be covered.

That is LITERALLY the entire point.

If only one person is paying into the insurance pool, and that person has a $20,000 loss, then that person has to pay the $20,000, whether or not they can afford it. The insurance company, to make sure they have the money to indemnify (a word that means ‘restore to their condition prior to the loss’ or ‘make whole’) that person, has to collect $20,000 in premiums in order to pay out on that $20,000 loss.

If 20,000 people are paying into the insurance pool and someone has a $20,000 loss, then all those people only have to pay one dollar. The Insurance company would only have to collect $1 from those 20,000 people in order to cover that $20,000 loss.

The way insurance premiums work is the insurance company looks at loss information. Sometimes they purchase studies and reports from third parties who literally exist to do NOTHING ELSE but track certain kinds of loss. They figure out how much of that loss they will be financially responsible for in a given fiscal year, as well as their administrative costs, and they divide that number by the number of people paying premiums. That’s how you get your insurance premium. It’s literally called the Law of Large Numbers – we figure out how much we have to charge you by figuring out how much risk we’re taking on by studying thousands of people who are, in this case, driving cars and having accidents.

If, for example, in Tornado Valley the number of claims for hail damage have gone up thirty percent since last year, then we will have no choice but to charge 30 percent more for the coverage that pays for hail damage to your car. Car insurance costs have gone up recently because more people are texting while driving, so the number of accidents have gone up sharply. Car insurance costs have gone up recently because medical payments have increased in cost, and we also cover that. Car insurance costs have gone up because a bumper that used to cost $200 to fix now contains sensors and back-up cameras that cost $5000 to fix.

If we didn’t rate for that, you’d be on the hook for all those increased costs… not indirectly, by a relatively small increase in your premium, but DIRECTLY, to the tune of thousands of dollars.

There are arguments to be made about American healthcare and how it’s tantamount to price gouging. There are also arguments to be made about how if you’re extremely wealthy, you should contribute more to the insurance pool than people who are making very little money (which would occur anyway, we hope, because health insurance is contributed to through taxes, not through private companies charging premiums). But the fact remains that the very institution of insurance RELIES on huge pools of people paying in so that nobody is financially destroyed by a loss.

Excellent commentary/explanation.

Diversion: I find it ironic that the people who were explicitly told by their leader to love their neighbours are, in 2017 America, the ones most likely to insist on cutting their neighbours loose because “this is my money, I earned it, they didn’t, they don’t deserve it”.

Oh my god I just realized, none of them understand this because none of them paY FOR THEIR OWN FUCKING HEALTH INSURANCE